How do I cancel my car/motorcycle insurance policy? What are the consequences?

You might be planning to cancel your car/motorcycle insurance policy for several reasons; selling your vehicle, a change of policy coverage or even a change in insurer. Here are a few valid reasons you could cancel your policy for:

- When you move to a country that your existing policy does not cover, and it cannot be extended to cover your vehicle.

- When you do not want to transfer the ownership of your current policy to the new owner of your vehicle and instead let the new owner start a new policy on their own.

- When you find a better deal from another insurer. For example, have you heard about our PrOmilej product? Switch now and save up to 40% on your insurance premiums for driving less!

However, always make sure to fully assess the risks in cancelling your policy early – here are a few reasons you shouldn’t cancel your policy just yet:

- Avoid cancelling your policy if you still plan on driving/riding your vehicle.

- Avoid cancelling your policy just because you moved to a different state, as your existing policy should cover the whole of Malaysia.

- Avoid cancelling your policy due to getting married or divorced as endorsements can be easily done on your policy to add/remove their name and amend your marital status.

Things to note:

- Avoid a lapse in coverage by ensuring that you have another policy in effect before you cancel your existing policy.

- Bring your road tax when going to JPJ.

How to cancel your car/motorcycle insurance

- First,if you have an active road tax, proceed to cancel your road tax at any JPJ branch.

- Next, contact your insurance provider to cancel your policy.

For P&O Insurance, you can contact us via our website, https://www.poi2u.com/contact, write to us, or email us at poi2u@pacific-orient.com. During office hours, you may dial 1800-88-2121 or message our WhatsApp number 019-3253855 for assistance. If you purchase via an agent, please contact your agent for cancellation assistance.

- Next, complete and sign your Cancellation Letter and return the Certificate of Insurance (if applicable).

- Once the cancellation has been processed successfully, a cancellation notice will be shared to you.

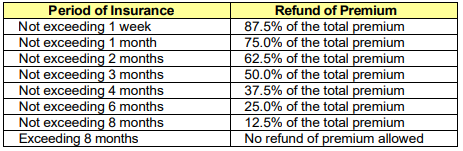

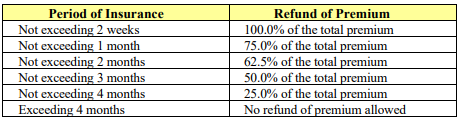

- Finally, sit back and wait for your refund, if any. Our refund structure is as follows for the following products:

*Note: Refer to your Policy document for full details.

Consequences of cancelling your motorcycle/car insurance

Below are some of the consequences of cancelling your motor policy:

- No insurance Coverage If you are still using your vehicle after cancellation, you may run a risk of being fined by the police and bear the full cost in event of an accident, including (where applicable) third-party damages and bodily injury if you are at fault.

- Additional inconveniences after a lapse in coverage If you cancel your insurance but do not purchase a new policy for a long period of time, some insurers may require you to bring your vehicle in for inspection before they approve and allow you to purchase a new policy. Furthermore, some insurers may charge you more.

- No NCD contribution If you cancel your insurance early, please be aware that your NCD will not increase to the next level.

Congrats! You are now familiar with the cancellation process, as well as the potential consequences. If you are looking for motor insurance, head over to www.poi2u.com and discover the right insurance product for you, now complete with road tax services.

Stay safe, keep informed and check it out.